Image source: Getty Images

I typically aim to hold FTSE shares for long periods of time, often several decades. However, every so often, I need to rebalance my portfolio and that can mean parting ways with stocks I’d rather keep. Usually, the idea is to sell shares that I expect will underperform over the long run, freeing up capital for stronger opportunities.

Of course, no one can predict the future perfectly. Even with a detailed analysis, there are still times when a decision doesn’t age well. Here are two shares I sold in recent years that, in hindsight, I regret letting go.

Barclays

Barclays (LSE: BARC) is the second-largest of the UK’s high street banks. I sold my shares just over a year ago because my portfolio was too heavily weighted towards financials. Faced with a choice, I kept HSBC and let Barclays go, thinking it was the safer long-term bet.

Looking back, that decision may have cost me. Barclays shares are up 317% in five years and over 90% since I sold, while HSBC is closer to 60%. Even including dividends, Barclays has comfortably outperformed.

While HSBC offers a higher yield of around 4.7%, its dividend coverage is thinner, leaving more risk of a future reduction. Both have been paying dividends consistently for decades and raised payouts each of the last four years.

Valuation is another factor. Barclays currently trades on a forward price-to-earnings (P/E) ratio of about 9, which looks undemanding compared to forecasts for earnings growth. That suggests investors could still think about it as an appealing entry point, even after the rally.

Of course, the risks are clear. Banking is a cyclical industry, and profitability can swing sharply during downturns. With interest rates easing both in the UK and globally, margins could come under pressure.

Yet, if I were rebalancing today, I think Barclays is a bank stock investors might want to consider.

Card Factory

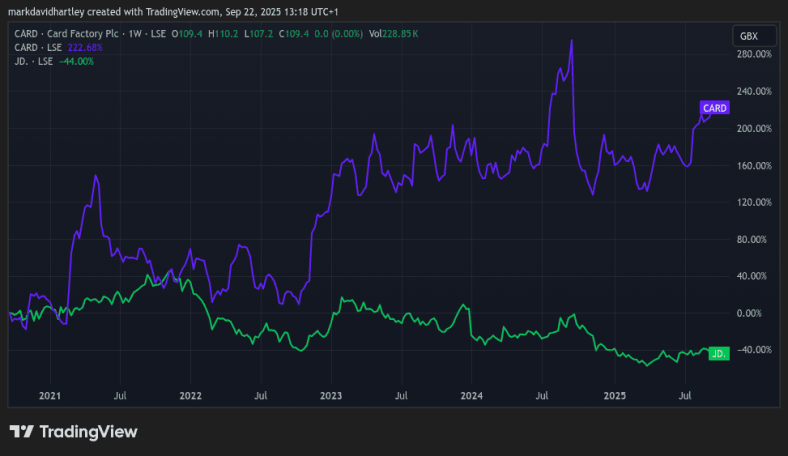

Card Factory (LSE: CARD) was another difficult decision. I sold my stake six months ago while trimming back retail exposure. The choice came down to JD Sports versus Card Factory, and I decided JD offered more long-term growth potential through global expansion. Since then, JD is down about 8% while Card Factory has surged nearly 30%. That hurts to admit.

The long-term comparison is even starker. Over the past five years, JD’s strong performance has faltered, whereas Card Factory has pushed through the pandemic challenges and emerged stronger. It also offers a dividend yield of around 4.4% compared to JD’s modest 1.1%. For income investors, that’s a big difference.

Still, Card Factory isn’t risk-free. Retail is vulnerable to inflation, supply chain issues and shifts in consumer habits. If discretionary spending falls, sales of greetings cards and gifts could suffer.

While I’ve chosen to stick with JD for now, the numbers suggest Card Factory is one to check out for investors weighing up retail stocks today.

Final thoughts

These are just two examples where, in hindsight, I wish I’d held my shares rather than selling too soon. It reinforces the old investing adage that time in the market often beats timing the market.

Even the best-laid strategies can feel flawed in the short run, but for long-term investors, the key is consistency, patience and learning from past decisions.