Contemporary Amperex Technology Co. Ltd. (CATL), the world’s largest battery maker, grabbed the spotlight again after JPMorgan’s upgrade sent its shares higher. This move reflected rising optimism around CATL’s earnings outlook and China’s aggressive push into battery energy storage systems.

CATL Soars on JPMorgan Upgrade and Earnings Boost

CATL’s Hong Kong-listed shares jumped 10.2% to HK$476.8, their highest since the company’s May listing. Its Shenzhen-traded shares surged 14% to 371.52 yuan, the strongest level since late 2021.

JPMorgan analyst Rebecca Wen raised CATL’s 2025–2026 earnings forecast by nearly 10%, a Street-high estimate on expectations of strong Q3 production and rising energy storage demand.

By the close, CATL’s Hong Kong shares ended 7.4% higher, while Shenzhen shares gained 9.1%. Offshore valuations now trade about 20% above mainland prices, a rare premium among Chinese dual-listed firms.

China Doubles Down on Energy Storage

CATL’s rally came just as Beijing unveiled an ambitious plan to nearly double new energy storage capacity to 180 GW by 2027, representing roughly $35 billion in direct investment. The target marks a nearly 90% increase from the current 95 GW installed, with most of the growth coming from lithium-ion batteries.

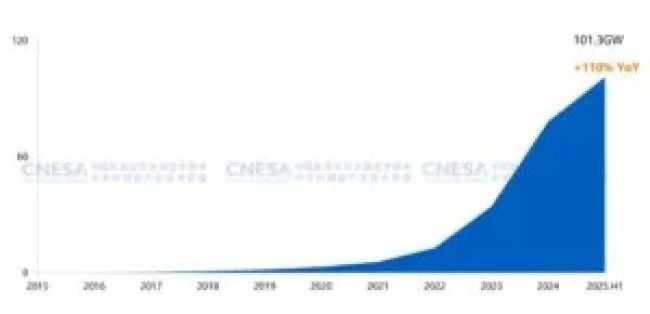

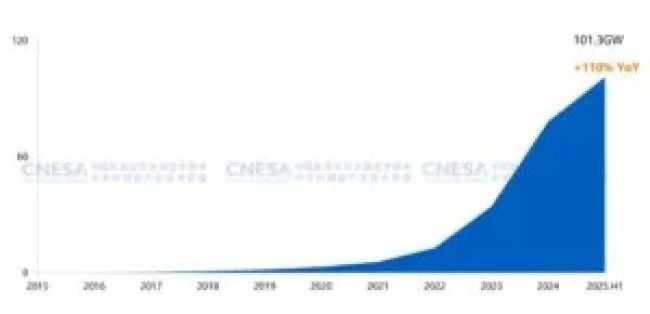

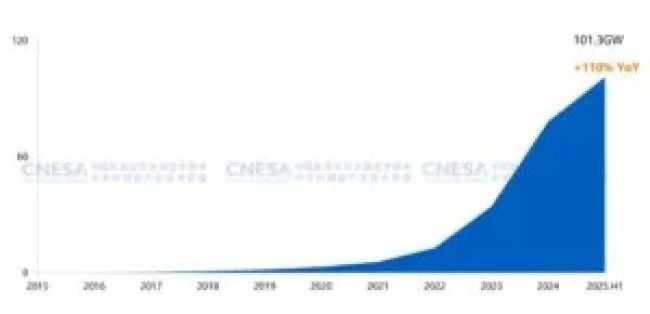

According to the China Energy Storage Alliance (CNESA), the country’s cumulative power storage capacity reached 164.3 GW by June 2025, up 59% year-on-year. This broadly means it surpassed 100 GW for the first time this year, a milestone that is 32 times greater than at the end of the 13th Five-Year Plan.

Pumped hydro’s share has now dropped below 40%, showing a shift toward lithium-ion battery dominance.

- In just the first half of 2025, newly commissioned storage projects reached 23.03 GW/56.12 GWh, a 68% jump year-on-year.

May alone set a record with 10.25 GW/26.03 GWh of new installations, climbing more than 500% from a year earlier.

CATL Positioned to Benefit

CATL is expected to be one of the biggest winners from this rapid growth. The company has already deployed over 256 GWh of energy storage capacity across more than 1,000 projects worldwide.

Notably, China has consistently beaten its own targets, having reached its original 2025 goal of 30 GW two years ahead of schedule.

Market Leadership Stays Firm

CATL continues to dominate the global battery market, holding a 37.5% share in the first seven months of 2025, more than double that of BYD. In August, CATL’s market share in China rose to 42.4% from 41.4% the prior month, according to the China Automotive Battery Innovation Alliance.

Financial results also highlight its strength. CATL’s Q2 net income surged 34% to a record high, while rival BYD reported a profit decline. Analysts say CATL’s premium reflects its role as a proxy for China’s clean energy ambitions and its unrivaled scale in energy storage.

Energy Storage Boom Lifts Entire Sector

CATL’s rally boosted other Chinese battery and clean energy stocks. Companies like Hunan Yuneng New Energy Battery Material, Sungrow Power Supply, and Eve Energy all surged in Monday’s trade.

Investor attention now turns to the World Energy Storage Conference in Ningde, Fujian—CATL’s hometown. The event is expected to spotlight China’s dominance in the energy storage sector and reinforce CATL’s role in driving the global clean energy transition.

China’s Megaprojects Leave U.S. Battery Storage Trailing

Mentioned before, China plans to more than double its battery storage capacity to 180 GW by 2027, supported by a $35 billion investment push and dozens of gigawatt-scale projects. The country’s National Energy Administration already reported about 95 GW of new energy storage installed by June 2025, showing just how fast capacity is expanding.

By contrast, U.S. Energy Information Administration (EIA) data shows domestic storage stood at only 28 GW at the end of Q1 2025, with projections to reach around 65 GW by 2026. This gap highlights the significant disparity between the U.S. and China’s scale. While America has strong growth momentum, most projects remain below the 1 GW mark.

The largest, California’s Moss Landing Energy Storage Facility, currently has about 750 MW / 3,000 MWh of capacity after expansions—impressive, but modest compared to China’s gigawatt-scale rollouts.

In conclusion, we can say that CATL’s stock surge reflects strong earnings momentum and China’s rapid energy storage buildout. With China doubling its energy storage target in another two years and lithium-ion batteries dominating new projects, CATL is set to capture a major share of this growth. Its market leadership and record profits position it as the key driver of China’s clean energy ambitions, leaving the U.S. trailing in large-scale storage deployment.

READ MORE: