Nature’s Miracle Holding Inc., a publicly listed company (NASDAQ: NMHI) focused on agriculture technology and indoor farming, is making a bold entry into the carbon credit industry. The company plans to buy a $20 million carbon credit portfolio that will cut about one million metric tons of carbon dioxide.

NMHI will also use blockchain technology to boost transparency and efficiency. This move shows that smaller companies are joining the growing carbon market. They use digital tools to improve trust and access.

A $20M Leap into Carbon Credit

Nature’s Miracle signed a Letter of Intent to buy $20 million in carbon credits from Carbon Credit Corporation, a company based in Taiwan. These credits represent one million metric tons of CO₂ reductions. That’s about the same as the yearly emissions from 220,000 gasoline cars or the energy used by 125,000 homes.

Credits mainly come from hydroelectric and methane capture projects in Asia and South America. Together, these sectors account for about 40% of voluntary carbon credits issued worldwide, which are registered with Verra’s Verified Carbon Standard (VCS). It is the largest carbon registry, overseeing over 75% of all carbon credits traded worldwide.

To pay for the deal, Nature’s Miracle plans to issue new company shares. For a company with a market cap under $100 million in 2025, this investment is big. It may change the business, moving beyond agriculture tech into environmental finance.

In addition to its carbon credit push, Nature’s Miracle is also moving into electric vehicles with a plan to tokenize a $100 million EV sales order. The company plans to use the XRP Ledger. They will convert customer deposits into digital tokens.

Each token will represent a fraction of an XRP-backed contract. These tokens can then be traded on real-world asset (RWA) exchanges or redeemed at contract maturity. The goal is to merge EV sales with blockchain innovation. This gives customers access to vehicles and the chance for investment returns.

Why Blockchain for Carbon Credits?

The carbon market has long faced criticism over a lack of transparency, double-counting, and difficulty in tracking credit ownership. Blockchain offers a promising solution. It creates a permanent and verifiable digital record for every transaction.

Through the XRP Ledger blockchain, Nature’s Miracle plans to tokenize each carbon credit, turning it into a digital token. This allows credits to be traded more easily across markets and retired once used.

Blockchain tools in carbon markets can:

- Track the origin and transfer of credits in real time.

- Prevent double-counting or fraudulent claims.

- Increase liquidity by making trading more efficient.

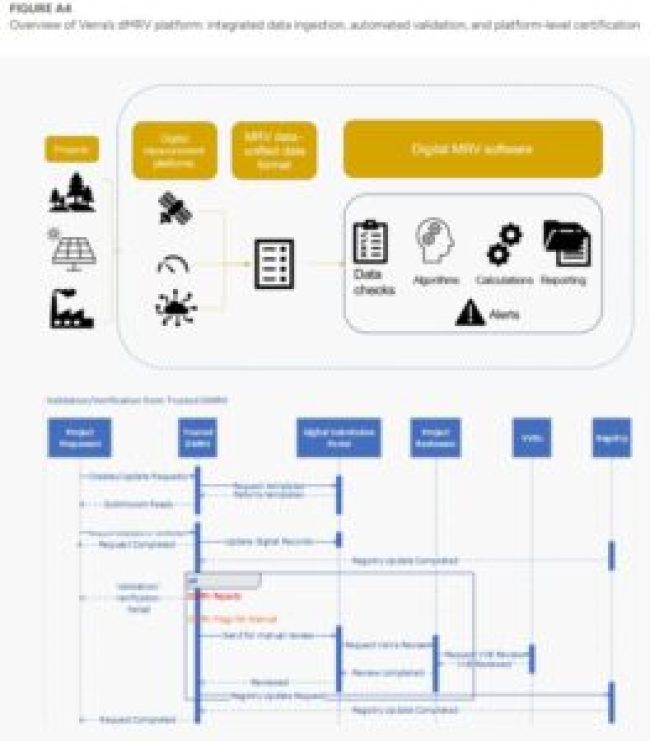

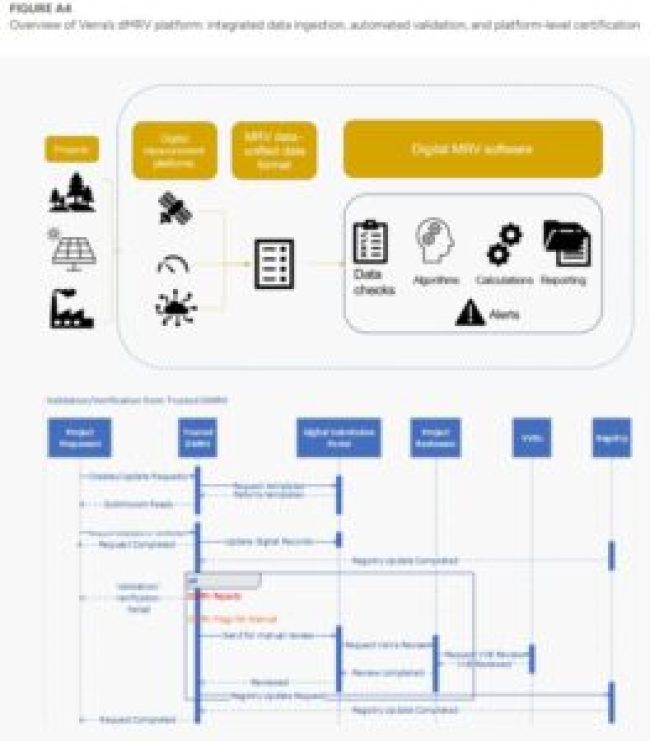

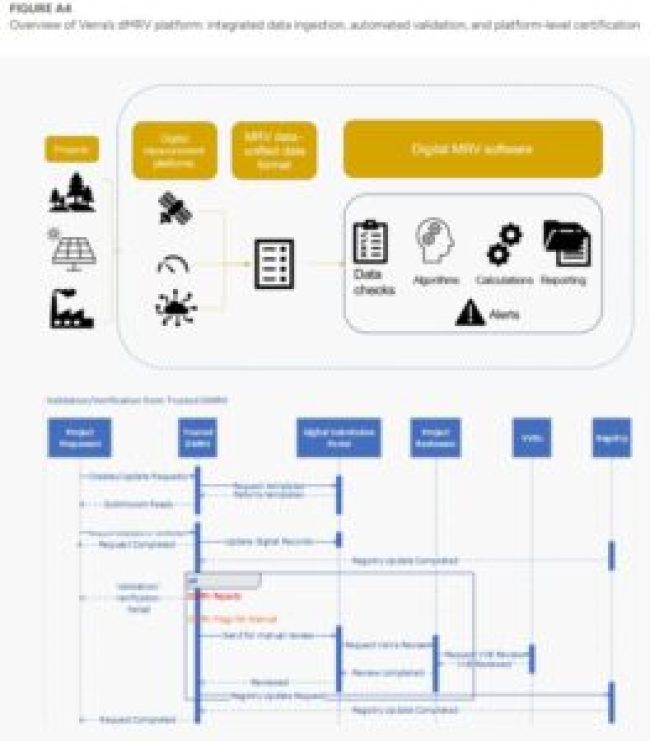

This idea of tokenizing carbon credits is gaining momentum. In 2024, the World Bank reported that more than 60 pilot projects worldwide were exploring blockchain or digital MRV (monitoring, reporting, and verification) systems for carbon markets.

Moreover, an analysis shows that in 2025, more than 60% of new carbon credit platforms are using blockchain, with most focused on agriculture and forestry projects. A study further shows that blockchain can boost carbon markets, reduce inefficiencies, and aid climate action and the Sustainable Development Goals (SDGs).

Riding the $250B Carbon Wave

The global carbon market is expanding quickly as governments and companies act on climate targets. In 2024, the voluntary carbon market was worth around $2 billion. Analysts expect it to reach $50 billion by 2030 and up to $250 billion by 2050 if demand keeps rising.

Key drivers of this growth include:

- Corporate net zero pledges: Over 9,000 companies worldwide have set targets to cut or offset emissions by 2050.

- Government regulations: Policies like the EU’s Carbon Border Adjustment Mechanism are increasing demand by putting a price on carbon-intensive imports.

- Rising carbon prices: In compliance markets such as the EU Emissions Trading System, prices reached over €100 per ton in 2023, up from less than €30 per ton in 2020. It stabilizes at around €100 per ton in mid-2025.

Carbon credits are a bridge solution for firms that cannot yet eliminate all emissions. They allow companies to support renewable energy, forest protection, or clean technology projects while continuing to cut emissions internally.

High Risk, High Reward

For Nature’s Miracle, entering the carbon market creates opportunities but also major risks. This acquisition allows the company to expand beyond indoor farming. It positions it in a fast-growing industry.

A successful blockchain platform could attract corporate buyers and investors looking for trustworthy carbon credits. However, the risks are equally significant.

The company’s market value is small compared to the $20 million portfolio it is acquiring. Financing and managing the credits will be a test of its capacity. Investor confidence has also been weak, with the stock losing more than 60% of its value in the past 12 months.

Blockchain Meets Carbon: What Other Blockchain Carbon Projects Do

Nature’s Miracle is not the first to explore blockchain for carbon markets. Other notable projects include:

Known for bringing carbon credits onto the blockchain by “bridging” them into digital tokens on Polygon. Toucan was one of the first large-scale efforts to tokenize credits, with over 20 million credits in 2021-2022.

A decentralized autonomous organization that built a carbon-backed cryptocurrency. By using blockchain incentives, KlimaDAO aimed to create demand for tokenized credits and raise their price. It has attracted more than 17 million tons of credits into its treasury at its peak.

Backed by venture capital and co-founded by WeWork’s Adam Neumann, Flowcarbon has focused on issuing carbon-backed tokens and building a marketplace for transparent trading. It has raised $70 million in funding in 2022 to develop blockchain-based carbon tokens.

Unlike these startups, Nature’s Miracle is a publicly traded company with an existing agricultural technology base. Its plan to tokenize Verra-registered credits on the XRP Ledger may appeal to investors looking for a link between traditional finance and emerging digital tools.

From Fields to Finance: What This Means for the Future of Carbon Markets

The Nature’s Miracle deal highlights a shift from pilot projects to real strategies in carbon finance. Tokenization might boost trust in carbon offset markets. These markets lost momentum in 2023 after reports raised doubts about credit quality.

If successful, blockchain adoption could make it easier for both small and large companies to trade and retire credits. Over 40% of Fortune 500 companies already use carbon offsets in their climate strategies. Many are also looking for better tracking systems.

The coming years will reveal whether regulators and big corporate buyers accept tokenized credits. If they do, blockchain could become a standard tool in emissions accounting. If not, it may remain a niche experiment.

Nature’s Miracle’s plan to acquire $20 million in carbon credits is a bold step for a small company. By tokenizing these credits on the XRP Ledger, it is entering both the carbon finance and blockchain arenas.

The move highlights the growing demand for transparent, credible carbon markets. It also shows how innovation in finance and technology is shaping the global response to climate change. Whether Nature’s Miracle succeeds or struggles, its entry marks another step in merging agriculture, carbon markets, and digital tools in the fight against global warming.